Why Bogotá?

Bogota: the best investment decision.

Bogota: the best investment desicion.

Bogota: the best investment decision.

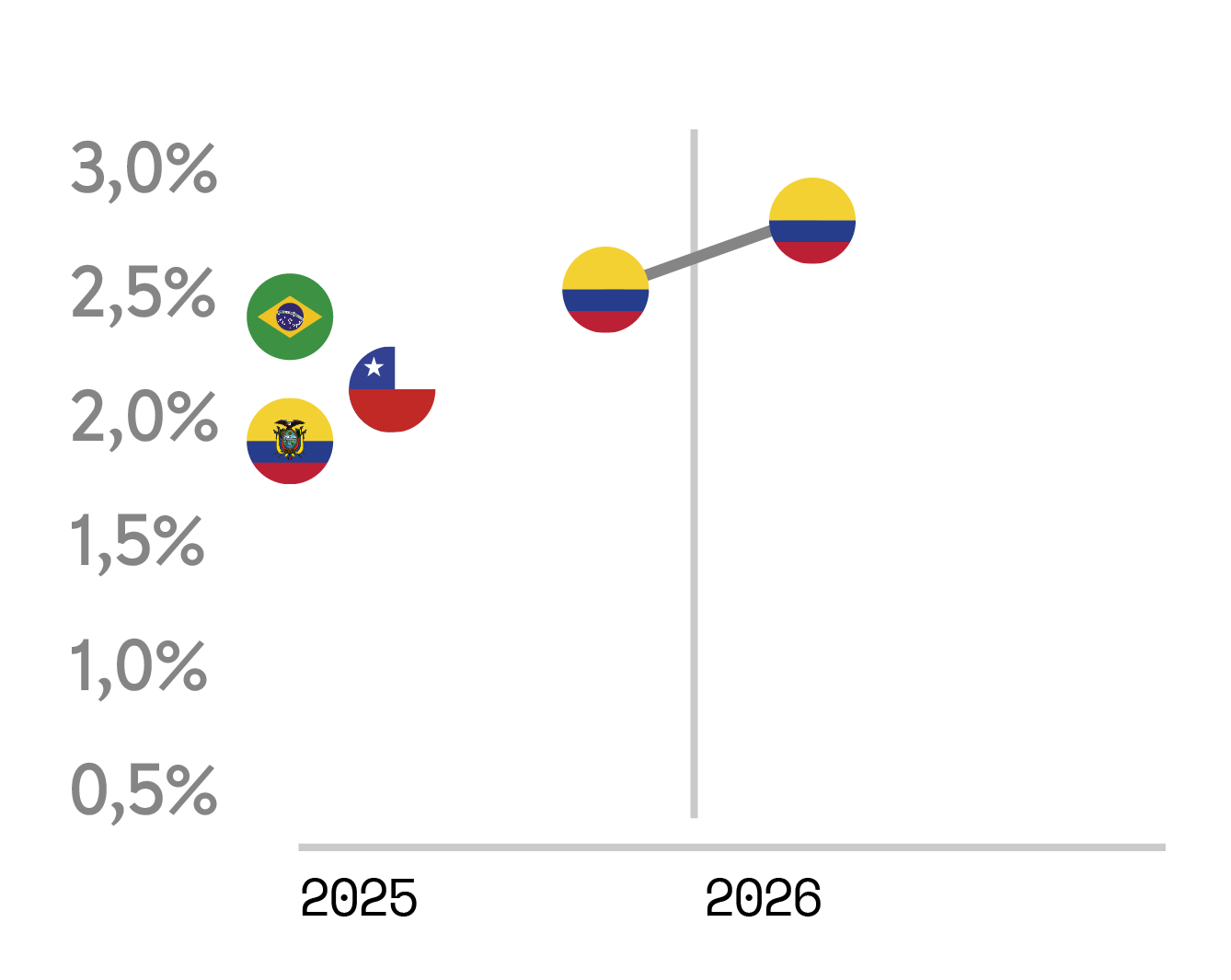

Economic growth projections

Source: World Bank, DANE (2024)

According to the World Bank, Colombia is projected to grow at a rate of 2.5% in 2025, outpacing countries such as Brazil (2.4%), Ecuador (1.9%), and Chile (2.1%). For 2026, Colombia is expected to be one of the fastest-growing countries in the region, at 2.7%, above the regional average of 2.0%.

Learn more

In terms of economic growth, Bogotá is expected to expand at a rate of 3.7% in 2025, according to the Medium-Term Fiscal Framework of the District Secretariat of Finance. This growth is higher than projections for Colombia (2.5%), Latin America (2.3%), and the global average (2.3%).

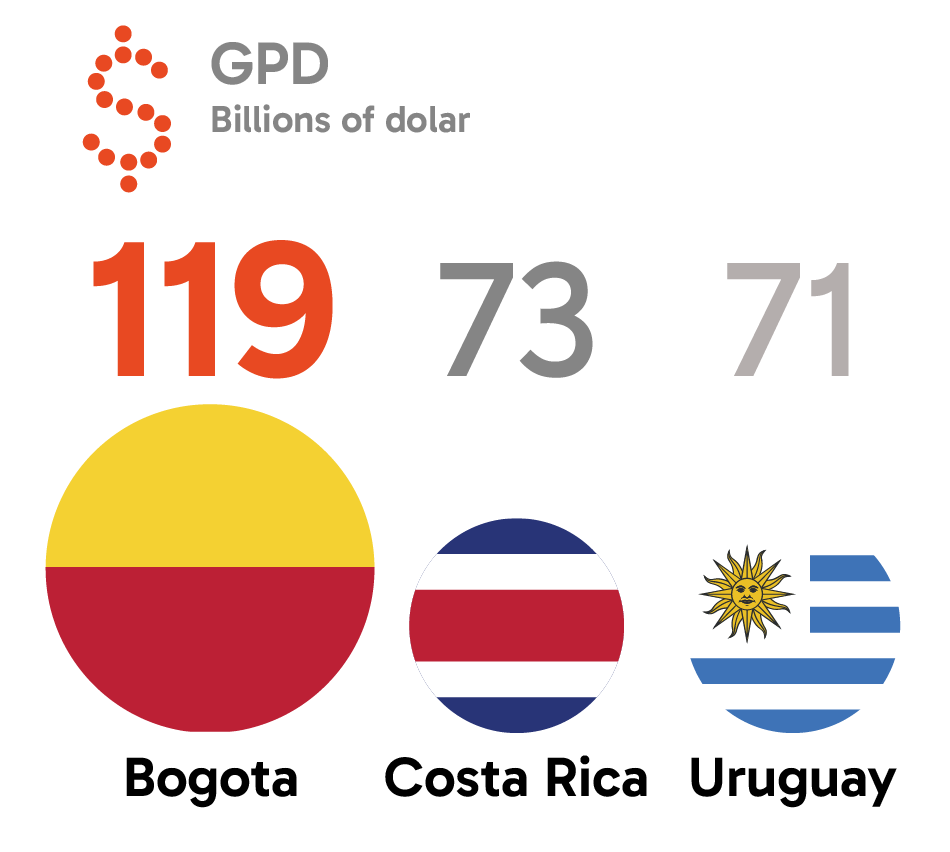

GDP Bogota-Region, higher than that of some countries

Source: World Bank, DANE (2024)

o Bogotá Region’s economy is robust and comparable with that of some countries in Latin America. Bogotá Region’s GDP totals USD 119 billion, exceeding that of countries such as Costa Rica or Uruguay.

Bogotá represents 33% of Colombia’s GDP and is home to 22% of the country’s population. In addition, Bogotá’s GDP per capita is USD 10,490, significantly higher than the national average of USD 6,895.

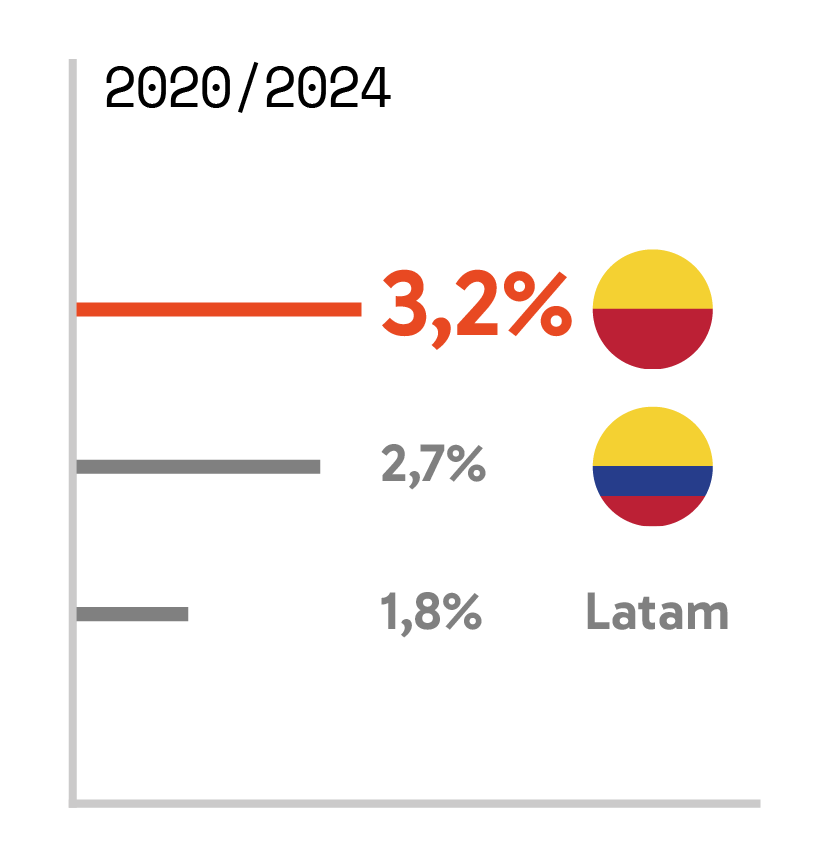

Economic growth

last 5 years

Source: World Bank, DANE (2024)

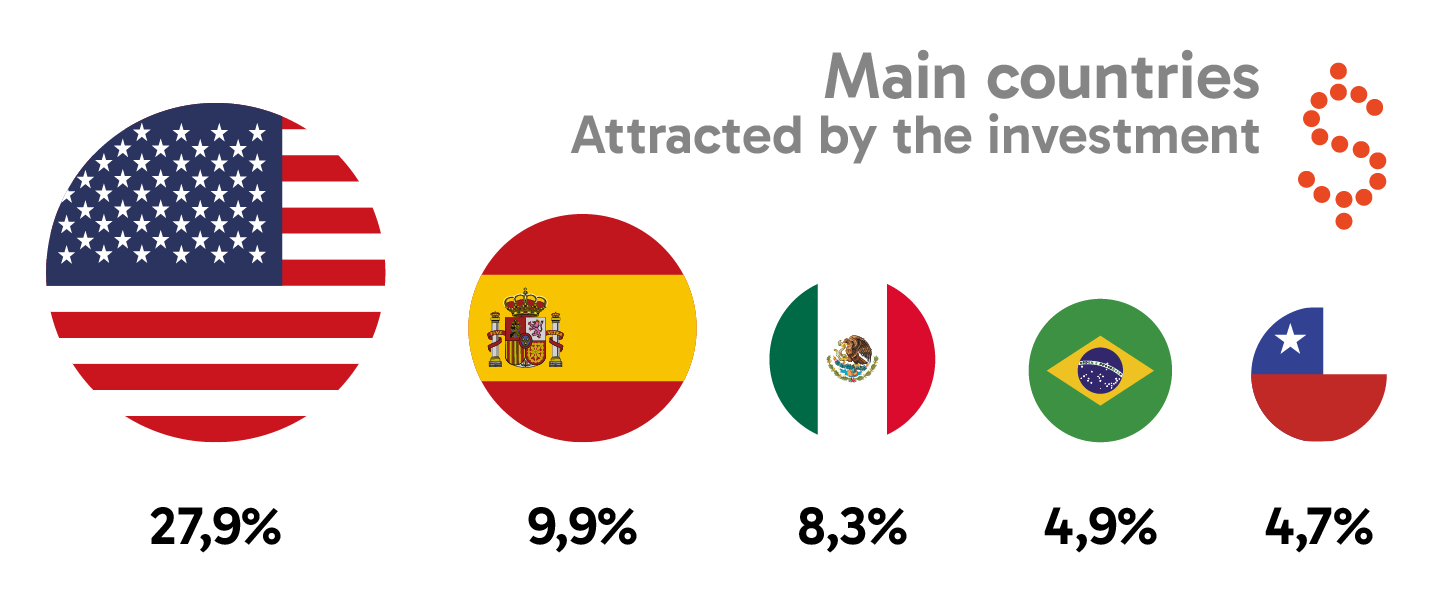

In the period between 2021 and 2024, Bogotá-Region has attracted investment from more than 40 countries. The United States leads as the main investor in the city-region, representing 27.9% of the total number of investment projects. Spain ranks second (9.9%), followed by Mexico (8.3%), Brazil (4.9%), and Chile (4.7%). In addition, investment from other European countries such as France, the United Kingdom, and Switzerland stands out, as does investment from Asian countries such as China, Japan, and India.

Bogota-Region's population, 2023

According to DANE, the population of Bogotá Region in 2023 was estimated at 11,352,608 inhabitants, representing 22% of the national total. According to the World Bank, Colombia ranked as the third most densely populated economy in Latin America and the Caribbean in 2023, with a total population of 52.1 million.

Learn more

Bogotá accounts for 25% of Colombia’s GDP and is home to 15% of the country’s population. Additionally, Bogotá’s per capita GDP is USD 11,498, significantly higher than the national average of USD 6,963.

Fuente: DANE (2024)

Bogota-Region as a dynamic business ecosystem

Source: Invest in Bogota based on information from Orbis Company (2024).

As of the end of 2023, the Bogotá Region is home to 2,464 foreign-capital companies (with at least one shareholder holding 51% or more of the capital), demonstrating international investors’ confidence in the local economy.

Bogotá is positioned as the foreign investment hub in Colombia, with more than 74% of the foreign companies established in the country located in the region. In addition, more than 400 companies listed in the Forbes Global 2000 (as of 2023) have chosen the Bogotá Region for their operations.

Learn more

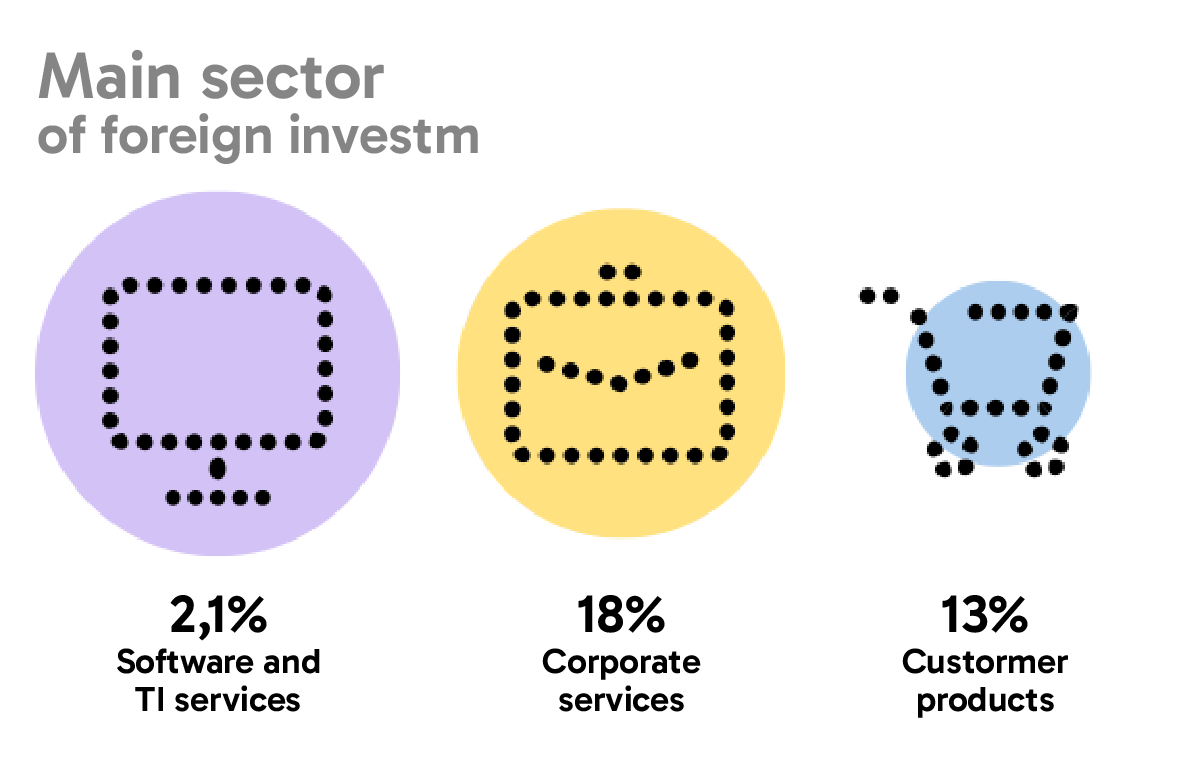

In Bogotá Region’s sectoral distribution of foreign investment, Software and IT Services leads with a 21.0% share. Corporate Services (18%) and Consumer Products (13%) follow, highlighting the diversity and appeal of the local economy for different industries.

Source: Invest in Bogota based on information from Orbis Company (2024).

Source: Invest in Bogota based on information from fDi markets, Orbis Corssborder and certifications (2024).

Between 2019 and 2023, Bogotá Region attracted investments from more than 40 countries. The United States leads as the main investor in the city-region, accounting for 25.9% of investment projects. Spain ranks second (11.4%), followed by Mexico (6.2%), Argentina (5.2%), and Germany (4.7%).

Leer más

Investments have also come from other European countries such as France, the United Kingdom, and Switzerland, as well as from Asian countries like China, Japan, and India.

In terms of sectoral distribution of foreign investment in the Bogotá Region, the software and IT services sector stands out, accounting for 21.0%. It is followed by corporate services (18.8%) and consumer products (6.7%), highlighting the diversity and appeal of the local economy to various industries.

Source: Invest in Bogotá based on information from fDi markets, Orbis Corssborder and certifications (2024).

Source: Dane (2024)

The active workforce exceeds six million people, reflecting a qualified, efficient, and bilingual human capital base compared with other cities in the region.

Source: QS Rankings (2024)

Fuente: Ministerio de Educación Nacional (2024)

The city-region has 3 of the 20 top universities in Latin America (QS World University Rankings: Latin America & The Caribbean 2025), 34% of the research groups, 37% of PhD holders, and 38% of the country’s technologists and technicians (Ministry of National Education, 2025).

The city’s human capital stands out for internationally competitive salary expectations compared with other cities such as Mexico City, São Paulo, and San José .

Source: Invest in Bogota based on information from fDi markets, Orbis Corssborder and certifications (2024).

Source: DANE, INDEC, INEI, Quito Chamber of Commerce, INE, Government of Chile, INEGI, Numbeo (2024).

In addition, Bogotá’s workforce is characterized by a culture of hard work, as increasingly, citizens value individual effort and hard work as a way to achieve results. (Casas & Méndez).

Time zone

Same time zone as the U.S. East Coast, and just 3 hours behind the West Coast.

Distance

Access to an extended market of over USD 5.9 trillion and 660 million people within a six-hour flight.

Weather

Temperate climate year-round (which supports productivity and reduces energy costs).

Source: Aerocivil. Flightconnections. Distances and times were obtained using an air distance estimator. The extended market refers to Latin America and the Caribbean.

Bogotá is a 5-hour flight from New York, Mexico City, or São Paulo.

Bogotá has a minimal time difference with major business centers such as Chicago (0 h), New York and Toronto (+1 h), Los Angeles (-2 h), São Paulo (-2 h), which makes it an attractive place to do business.

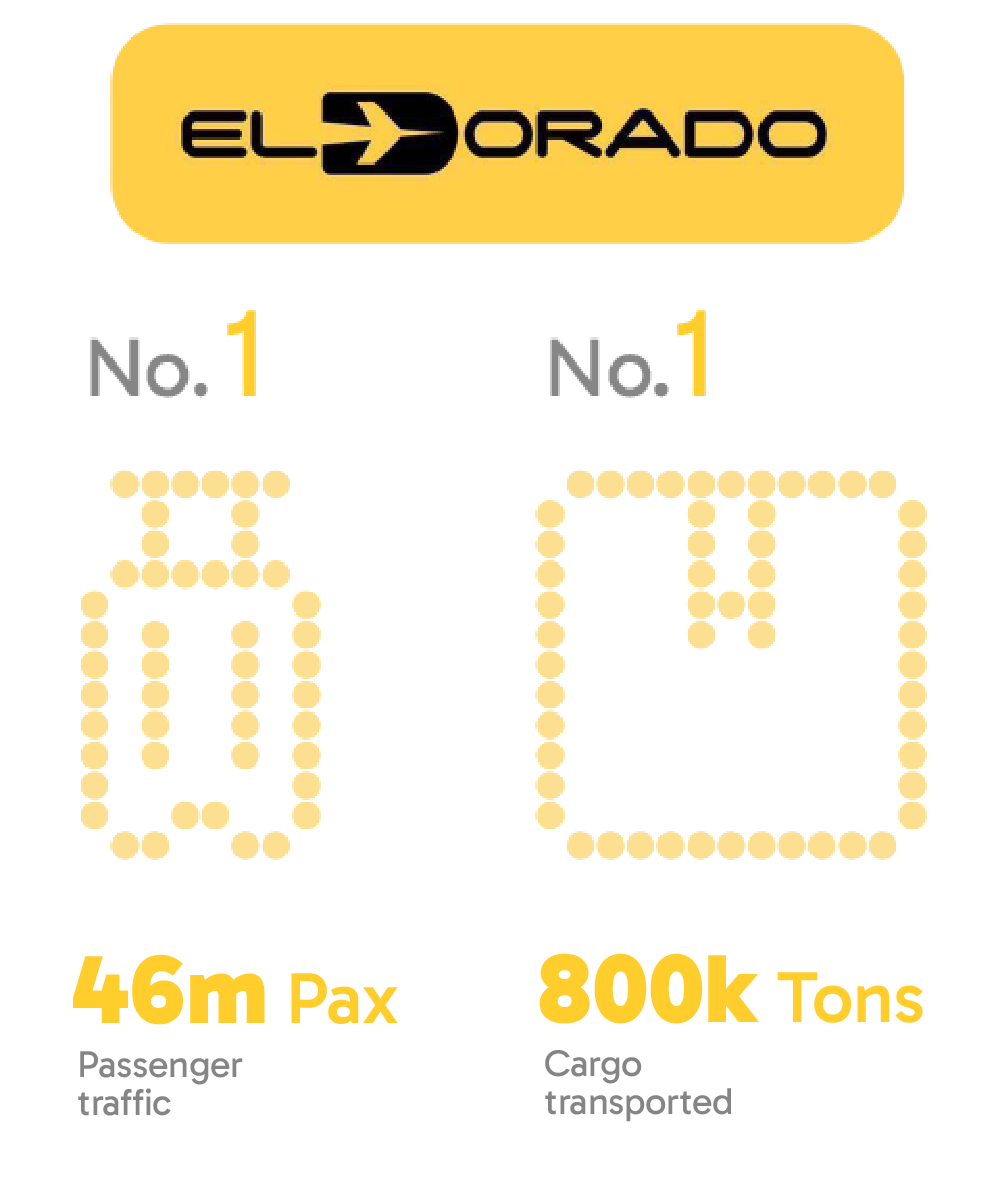

Bogotá’s strategic geographic location and time zone have made it easier for participants to access international events held in the city, not to mention that, for the sixth time and for the third consecutive year, El Dorado International Airport was recognized as the Best Airport in South America at the Skytrax World Airport Awards 2025.

Source: Civil Aeronautics

El Dorado International Airport in Bogotá is the most important airport in Latin America, ranking as the leading airport in passenger transport and in cargo transport. It moves more than 46 million passengers per year and more than 800 tons of cargo.

This advantage enables it to be connected with more than 67 countries through free trade and investment agreements.

With an internal market of 11.4 million people and an extended market of more than USD 5.8 trillion with 660 million consumers in Latin America and the Caribbean, Bogotá – Region is consolidating its position as a strategic gateway for scaling businesses in the region.